Personal Loan EMI Calculator

Also Check:

All Banks Personal Loan EMI Calculation & Comparison

EMI Per Lakh Rupees of Loan

[table id=31 /]

Factors Affecting Loan EMI & Interest Payment

#1. Loan Amount

You can be eligible for a maximum loan amount based on your monthly repayment capacity (Monthly Income – Expenses – Other EMIs) and loan tenure.

But never take the loan more than you need. If you go for a higher amount, obviously the EMI and Interest amount will be high.

#2. Interest Rates

The EMI and total repayment amount will be high if you borrow the personal loan at high interest rates. In India, the personal loan interest rate varies from 10.50% to 24% depending upon factors like the bank, risk profile of the borrower, loan amount, etc.

If you have a regular income source, proper documents, and good credit score then banks will offer comparatively lower interest rates.

#3. Loan Tenure

Most of the banks promote the lowest EMI offers by increasing the loan tenure. Here borrower makes the biggest mistake by taking the higher tenure loan.

If you want lower EMI with a higher loan amount then you have to increase the loan tenure which will increase the interest component significantly.

Below example shows how interest component changes when you go for lower EMI and high tenure offers:

Loan Amount Rs. 10,00,000 @12% p.a.

[table id=32 /]

Personal Loan Prepayments

If you have an additional sum of money and wants to save the interest then you can pre-pay the outstanding loan before the completion of the loan tenure.

You can either go for full pre-closure of loan or for part pre-payment of the outstanding loan. Normally, banks charge pre-closure fees up to 5% of the outstanding loan.

If you opt for part pre-payments of the personal loan then banks will give you two option for revised outstanding loan:

Option 1: Reduce the Repayment Tenure & No Change in EMI amount

Option 2: Reduce the EMI amount and No Change in Loan Tenure

If you really want to save the interest cost then you should opt for option-1 – “reduce the repayment tenure and keep the same EMI”

FAQs – Personal Loan Calculator

What is Personal Loan EMI?

The full form of EMI is “Equated Monthly Instalment”. It is the Fixed Monthly Installment paid by the borrower to the lender towards the repayment of the loan.

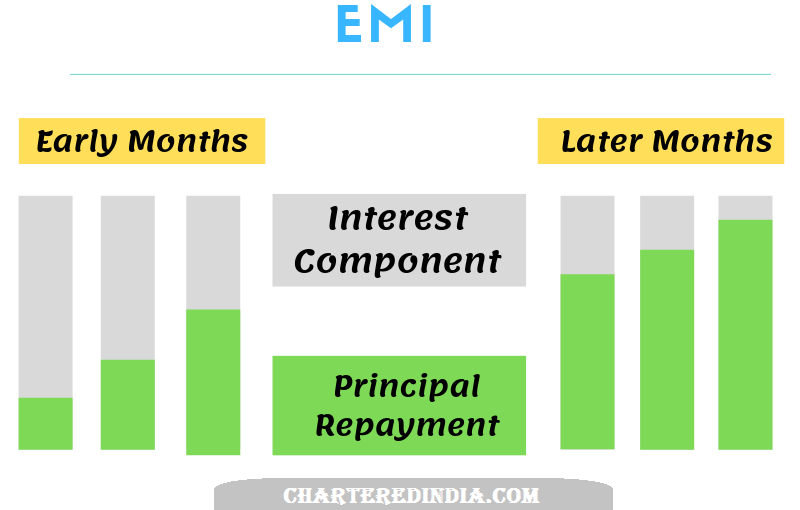

EMI is the fixed amount consists of two variable components:

- Interest on Outstanding Loan Amount

- Principal Repayment (i.e. EMI – Interest Part)

How to Calculate Personal Loan EMI?

EMI is calculated using the following formula:

Where:

E= EMI

P = Principal Loan Amount

r= Monthly rate of Interest

n = Loan Tenure (in months)

0 Comments